What’s Driving China’s Real Estate Rally? Part 2

Yesterday, I began an investigation into the potential causes behind the latest bump in China’s property sales numbers, and whether they portend a genuine turn-around in the nation’s real estate market. I noted that five basic theories to account for what has been happening, and promised to examine them each in turn:

- Lower Prices are Bringing Buyers Back

- Looser Restrictions are Unleashing Pent-Up Demand

- Optimistic Buyers are Misreading the Market

- Government Intervention is Boosting the Numbers

- Developers are Fudging Numbers to Stay Afloat

In my last post, I concluded that it was certainly possible that a fall in both real and nominal property prices could explain a recovery in sales, as properties become more affordable to buyers. However, this theory cannot explain the rebound in property prices reportedly taking place, nor should it offer much comfort to hard-pressed developers, who would may have to endure steep losses to clear their inventories at reduced prices. Chinese developers and bullish real estate investors much prefer a second theory that promises a return to both higher sales and higher prices.

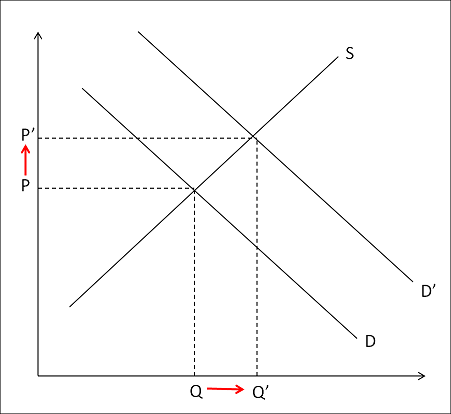

2. Looser restrictions are unleashing pent-up demand. The conventional explanation that you will hear for China’s real estate slowdown, from developers and from most of the media, is that it’s a direct result of government policies designed to “cool” the property market, including tightened rules on mortgages, residency requirements for buying, and — more than anything else — restrictions on multiple home purchases. As a result, many who wish to buy are not allowed to do so. If the government would only relax these restrictions, the argument goes, all that pent-up demand would come back onto the market. As the chart below illustrates, in contrast to the first theory we examined, introducing new demand (shifting the entire demand curve to the right) would boost sales for any given price, and cause both quantity and price to rise to a higher equilibrium point.

This is a dream scenario both for developers and for local governments that depend in various ways on a booming property sector, which is why both have been baying for months if not years about the need to relax the restrictions. Some local governments have succeeded in loosening or circumventing the central government’s tightening measures when Beijing wasn’t looking, and May brought a surge of rumors that the central government itself would have no choice but to reverse course as part of its effort to re-stimulate a slowing economy, a belief that prompted one Beijing developer to quip, “Ducks first know when the Spring river water begins to warm” — in other words, “Happy days are here again!”

But is the conventional story — that China’s government drove down the real estate market, and can just as easily resuscitate it — really correct? The evidence, I believe, demonstrates it is not.

Most of the government’s measures aimed at “cooling” the property market were adopted in April 2010 — over two years ago. I remember it well, because I argued at the time that such top-down restrictions would do little to change the dynamics that drove so many Chinese to pour so much money into vacant, unproductive real estate as a form of savings. I also distinctly remember the government ordering developers in key cities to take their most expensive units temporarily off the market, in order to (statistically) reduce the average market price and thereby show that the policies were producing immediate results. “Mission accomplished” was quickly declared.

The chart below, courtesy of Joanna Dong, the chief China economist at the mining firm Anglo American, shows the number of Chinese cities (out of 70 tracked in the official statistics) where property prices rose (blue) , fell (yellow), or remained the same (orange) each month. It is not weighted by market size, but it offers a good “heat map” of rising and falling prices by geography. And along with the national statistics on property sales and investment, it tells a very interesting story.

After the government’s cooling measures were adopted in April 2010, nationwide property sales did not decline, as one might expect. They rose by 18.3% YoY in 2010 and 24.1% YoY in the 1st half of 2011. Nor did real estate investment, which rose by 33.2% YoY in 2010 and 32.9% in the 1st half of 2011. In other words, the government’s cooling measures had little appreciable effect on a booming property market for the first 16 months they were applied, at least when measured on a nationwide basis.

The 70-city price map tells a bit more nuanced story. First you see a drop in about 20 key cities, which corresponds to the politically-engineered withdrawal of high-end units I mentioned. Then you see — strangely enough — a big surge in the number of cities reporting price increases which lasts until the summer of 2011, when the bottom falls out of the whole market. Again, for the first 16 months or so that “cooling measures” were in place, property prices continued rising in a large majority of Chinese cities, instead of stabilizing or falling. What happened?

The fact is, the government’s “cooling measures” were not terribly effective. Premier Wen Jiabao admitted as much at the end of 2010. They were only enforced in a few key cities, and even then, if you really wanted to purchase multiple apartments in Beijing, you could probably figure out a way to do it (through relatives, nominees, false documents, etc). What the “cooling measures” did do, however, was send investors a signal that, if they wanted to see outsized returns, they’d do best to look for them outside high-profile cities like Beijing and Shanghai, when China’s leaders were at least trying to rain on their parade.

Government-imposed restrictions didn’t rein in Chinese demand for real estate, as the national numbers indicate. But they did shift buyers’ attention away from a handful of 1st-tier cities — where prices stabilized or fell — towards 2nd and 3rd-tier cities in the provinces — where, as the chart shows, they surged. In other words, the party didn’t end when the cops showed up, it just moved down the street. In the summer and fall of 2010, I visited a number of provincial cities and asked developers there how the central government’s “cooling” policies were affecting their business. Every single one of them reported that they had experienced no effective restrictions; to the contrary, investors from other cities were showing up literally holding sackfuls of cash, looking to buy. When “cooling measures” were gradually extended to more cities, developers responded by building luxury condos and villas out in the countryside, whose sole selling point was that they lay outside the restricted zone, permitting investors to buy as many units as they desired.

China’s property market continued booming right through the summer of 2011, when — as the price chart shows — the wheels abruptly fell off. Why the sudden implosion? Because even as sales grew by 20% or so, investment in property development expanded at an even faster rate, higher than 30%. The government’s ineffectual “cooling measures” had lulled developers into a false sense of security: believing that buying restrictions had artificially suppressed demand — which was not true, except on a very localized basis — many developers borrowed heavily to build far more than they could sell, reasoning that they would be in a winning position when the government ultimately relented and relaxed its controls, and all that pent-up demand came flowing back onto the market. To support these rising unsold inventories, however, they needed to borrow more and more money — at the precisely the time China’s central bank was reining in credit expansion to combat inflation. By the end of last summer, Chinese developers finally ran out of funding options and were forced to begin liquidating their inventories to generate desperately-needed cash. The fire sale they initiated quickly undercut existing demand, as would-be buyers who had once rushed to beat rising prices now held back, now that every day brought larger discounts.

So if the government’s “cooling measures” were NOT the cause of China’s property downturn, is there any way the relaxation — or anticipated lifting — of those measures can possibly explain the rally we’ve seen over the past couple of months? Surprisingly, the answer may be YES — but the implications are not what struggling developers or China property bulls might like to imagine.

As we’ve seen, the government’s restrictive measures did not suppress overall demand, as many imagined. They merely redirected that demand away from 1st-tier cities, towards 2nd and 3rd-tier cities, as well as the countryside. Undoing those measures would have the opposite effect: allowing demand to flow back to 1st-tier cities like Beijing and Shanghai, while cutting the legs out from under the lower-tier (and potentially much more vulnerable) markets that benefited from the earlier diversion. Prime urban areas would see higher sales and higher prices, but the nationwide effect would be a wash. That may help explain the apparent disconnect between the rather astonishing statistics we see coming out of Beijing, Shanghai, and other big cities, and the much less impressive results revealed in the national statistics for June.

It’s also interesting to note, as well, that the latest rebound in Beijing, for instance, took place in anticipation of a policy change, even though buying restrictions and other “cooling” measures remained largely in place. That accords with my argument that it was the policy signal, rather than the practical effect of the restrictions themselves, that led buyers to shy away from Beijing and similar markets and channel their interest elsewhere. When the signal was perceived to have changed — when people came to believe the government would welcome a rebound in the city’s property market — they rushed back in, revealing the restrictions themselves to be an inconvenience, at most.

Critics will respond that, in fact, it was the government’s restrictive policies — its efforts to rein in lending — that brought the real estate market down. But it’s important to note that China’s leaders had little choice, given the need to combat rapidly rising inflation. More relevant to my argument, the constraints imposed by credit “tightening” (relative to developers’ spiraling credit needs) fell mainly on developers, not buyers — it did not create any reservoir of “pent-up demand” that later could be “unleashed” to boost the market.

This concept is worth clarifying. Developers, investors, and analysts often talk about there being “pent-up demand” in China for buying homes. But as I hope these last two discussions have illustrated, “pent-up demand” can mean very different things. In Theory #1, it means that if prices fall, the quantity demanded increases, although the calculus for demand does not change. In Theory #2, it means that a change in policy could shift the entire demand curve outwards, increasing the amount demanded at any given price. I have just argued that, in fact, it could mean demand increases in one location only at the expense of another, with overall demand remaining the same. All of these are very different dynamics, with different implications for developers, investors, and the Chinese economy. Very often, people conflate them under the broad and appealing notion that 1.3 billion people in China would really like to buy as nice a home as possible, if only they could. Of course they would. The essential question is under what conditions this general desire gets translated into actual purchases and at what price.

Next Installment: Theory #3, Optimistic buyers are misreading the market.

Trackbacks

- Pseudo Random News and Comment | Mortality Sucks

- Emerging & Frontier Markets Headlines 2012.07.25 - Diverging Markets

- What’s Driving China’s Real Estate Rally? Part 3 « Patrick Chovanec

- What’s Driving China’s Real Estate Rally? Part 3 |

- Chinese Real Estate May Be Doing The Dead Cat Bounce - Real Estate News | San Francisco Luxury Living

- What’s Driving China’s Real Estate Rally? Part 1 « Patrick Chovanec

- Weekly Round Up August 1st – 2012 | Connect the Dots

- Weekly Round Up August 1st – 2012 | Connect the Dots

- Quora

drive around the mega city of Chongqing and observe the many empty apartment blocks …. form your own conclusion. Empty apartments do not add any value to the economy, in fact it is a waste of resources. Low construction quality, 50 yr leases also means these are not good long term investments.

Reblogged this on kowapaolo and commented:

Seconda parte di Chovanec sull’immobiliare cinese

Professor, do you really think you can draw any conclusion with those inaccurate data?

I would definitely not rely on the official data as a sole foundation on which to draw conclusions, and I would not hesitate to question that data if I had reason. In fact, there is plenty of reason — as I noted in Part 1 — to question whether the price data fully reflects the volatility of prices, both up and down, in China’s property market. However, the reason I feel comfortable presenting this data in this context is that it corresponds, at least in its broad outlines, with the narrative that I was hearing and seeing unfold over the course of the past two years or so, and it helps illustrate some of the major trends in the market. I would not argue that it gives a precise picture of what was happening.

Professor, thanks for this analysis, and for all previous posts — very interesting and insightful stuff.

Does the recent rebound in the housing market make you less pessimistic on the outlook for the broader Chinese economy in the second half of the year and further? Seems like one of the first times in many months we are investigating the reason for a trend which is positive.

Is there a chance we’ve passed the worst in this Chinese slowdown? Certainly your predictions over the past year will have been prescient even if we have — that wouldn’t require an utter melt down.

Thank you.

Here’s my own guess at why China won’t re-inflate, written back in October. With supply-demand graphs to explain why…

http://www.kentwillard.com/5-ducats/2011/10/giffen-assets-gold-speculative-real-estate.html

The expectation of appreciation is all that drives demand on a speculative asset with no income and no utilitarian benefit. Once the expectation of appreciation is shaken, then so too is the demand. Liquidation then increases supply, causing the equilibrium price to return relatively quickly to a normal asset. Because of this, bubbles rarely re-inflate, though if the easy credit remains without a productive investment opportunity, then the money may find a different asset in which to speculate.

Seeing as housing prices follow the money supply I’d suggest that the prices are simply reacting to the supply of money and not to demand. Where else can the Chinese put their money? After the money supply doubled from 09-12 then hit the wall you’d expect to see exactly what we saw.

Prices of real estate will go up as long as banks continue lending ever increasing amounts of money.

“everyone in China knows plenty of people who have bought up several apartments as an investment, and (b) all it takes is eyes to see whole developments standing sold but empty, not just in “ghost cities” like Ordos”

Professor, although I am sympathetic to your view on this, how do you explain a sudden acceleration in rents (Rents are up 15% YoY) after staying flat for years. If there are plenty of empty apartments in Beijing and elsewhere, shouldn’t the rents come down? Of course the number (supplied by Chinese Index Academy) could have been fudged, there is widespread anecdotal evidence that rents are indeed on the rise.

Quality of construction in Chinese housing stock is poor, but it is especially atrocious in older buildings so one may see why there is a rush to ‘upgrade’ to newer construction.

You anticipate the question I’ll be addressing at the beginning of Part 4. I’m on a family vacation this week, I’ll post it ASAP.

One month has passed!!

Yeah, I know. I’ve been on the road. Interesting things have been unfolding in the meantime. I will continue the series ASAP.

I think you miss the point there on your first theory. It will surely have greater bounce rate on sales on the side of the company since many buyers will be attracted with these low prices as China, as I’ve seen, has a growing homeless population. So the more buyers, they would still have huge revenue although the prices are cheap.

Given the high prevailing price-to-income ratio, there would have to be a pretty substantial drop in prices for homeless people to start buying apartments. Also, I think you’re making an assumption about the price elasticity of demand, i.e., that sales volume will increase at a higher rate than prices fall.